Health Insurance for International Students studying in the USA

Unlike most countries, the U.S. doesn’t have a nationalized healthcare system. This means that as an international student, you are responsible for your own treatment by paying out of pocket, or you can purchase a private health insurance plan to help you in paying for medical bills. Yet, the United States healthcare system is expensive and complex to understand, even for most Americans.

As an international student, healthcare costs can easily overwhelm you, especially if you don’t understand the need to purchase a good insurance plan for the period you will be studying. Your international student health insurance plan is designed to cover most of the medical costs and it often works with in-network doctors who offer discounted medical services, which make your visits to the doctor more affordable.

Student Visas Insurance Requirements

J-1 Visa

The J-1visa has some requirements, and part of them require that visiting students and dependents should purchase and maintain a health insurance plan that meets some government requirements.

F-1 Visa

International students that are on an F-1 visa can purchase a health insurance plan that meets the school's requirement, but doesn’t necessarily have to meet the government's requirements. Depending on the university, you may be required to purchase the school health insurance plan, or you may be allowed to choose your own plan.

How to Get Medical Care in the Country you’re studying in

As earlier mentioned, international students on an F-1 visa should follow the school's health insurance guidelines. Therefore, depending on the institution you’re in, you may be required to enroll in the school's health insurance plan or you can purchase private coverage. Here are some of the most common health insurance situations that you may encounter:

School mandated plans: International students are required to enroll and purchase coverage in an insurance plan that is recommended by the school. The only way to skip out of a mandated health insurance plan is to prove that you already have a suitable plan through a sponsoring government or employer.

School-sponsored plans: International students can choose to enroll in the school’s plan, or purchase their own private insurance that meets the listed school requirements. However, school-sponsored plans rarely cover medical services that are rendered off-campus.

It is important to note that if you don’t meet the required number of credit hours per semester or you withdraw from classes regardless of whether it’s due to health-related issues, you will instantly lose your coverage.

Non-school-sponsored plans: Although this isn’t a popular option, some schools don’t have set insurance requirements for international students. This means that you can choose any health insurance plan that you want. There are several health insurance plans available for international students that are offered by non-educational providers. Most of these options are available for international full-time students that are between the age of 17 and 29 years studying at state-accredited colleges or universities.

Unlike school-sponsored medical care plans, this plan will move with you in case you decide to transfer to a school in a different state. However, such plans are more expensive. You may also have to pay a high monthly premium and they are unavailable in some states.

Features of International Student Health Plans

Renewable

Insurance for international students is provided as a monthly payment option and can be renewed within a period of four years. This will allow you to purchase a single plan for your entire study duration abroad. Some plans also offer incidental home country coverage. This means that after every three months of coverage, you can visit your home country for a period of two weeks and still receive care under your policy.

Specialized Benefits

Other than providing healthcare benefits such as prescriptions and hospitalizations, many international student medical insurance plans also include coverage for mental health, maternity expenses, organized sports, and pre-existing conditions. These benefits are often required by schools, but there are also other key benefits such as emergency medical evacuation and repatriation.

Younger Demographic Equals Lower Premiums

Because students are on average young and healthy, their health insurance plans are often more affordable. Premiums are determined by age and this allows you to remain in control of your coverage.

Family Coverage

Because of the specialized nature of these plans, most international student health insurance plans are limited in their coverage for dependents or offer this cover at a higher rate. Therefore, if you’re traveling with your family, you will have to pay more or choose another option such as a travel medical plan.

Get Professional Assistance

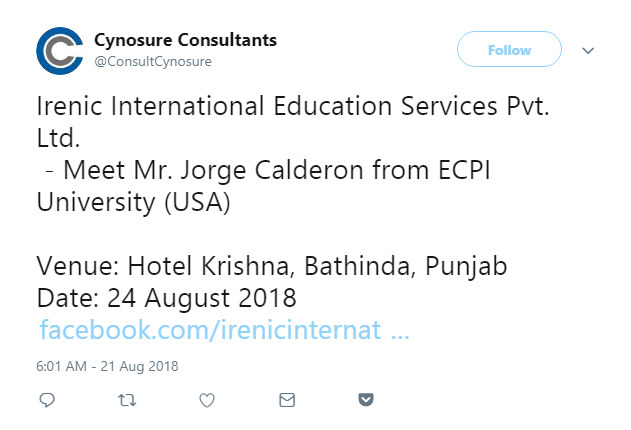

As you can see, navigating the United States healthcare system takes time and energy. ECPI University can help you figure out what health plan would be best for your while you study overseas at an ECPI University campus. For more information, connect with one of our skilled international admissions advisors.

It could be the Best Decision You Ever Make!

DISCLAIMER – ECPI University makes no claim, warranty, or guarantee as to actual employability or earning potential to current, past or future students or graduates of any educational program we offer. The ECPI University website is published for informational purposes only. Every effort is made to ensure the accuracy of information contained on the ECPI.edu domain; however, no warranty of accuracy is made. No contractual rights, either expressed or implied, are created by its content.

For more information about ECPI University or any of our programs click here: http://www.ecpi.edu/ or http://ow.ly/Ca1ya.